SMALL BUSINESS RESOURCES

Make Your New or Existing Business Successful

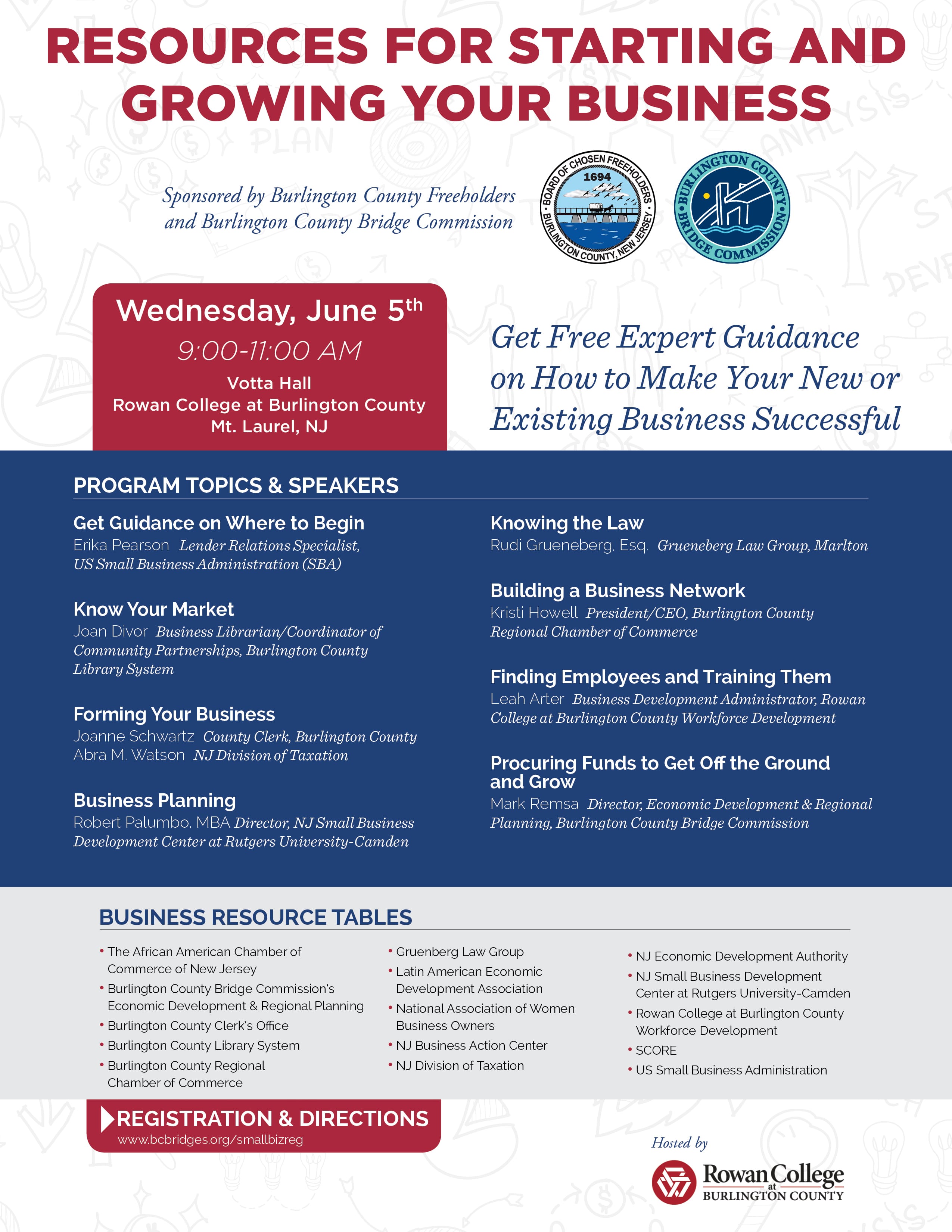

The free program, “Resources for Starting and Growing Your Business” was held Wednesday, June 5th at Rowan College at Burlington County. Sponsored by the Burlington County Freeholders and Burlington County Bridge Commission, this program featured 9 knowledgeable speakers that addressed the topics below (to access presentations, click on titles shown):

Get Guidance on Where to Begin

Erika Pearson Lender Relations Specialist,

US Small Business Administration (SBA)

Joan Divor Business Librarian/Coordinator of Community Partnerships, Burlington County

Library System

Forming Your Business

Wade Hale Deputy County Clerk, Burlington County

Abra M. Watson NJ Division of Taxation

Robert Palumbo, MBA Director, NJ Small Business Development Center at Rutgers University-Camden

Rudi Grueneberg, Esq. Grueneberg Law Group, Marlton

Kristi Howell President/CEO, Burlington County Regional Chamber of Commerce

Finding Employees and Training Them

Leah Arter Business Development Administrator, Rowan College at Burlington County Workforce Development

Procuring Funds to Get Off the Ground

and Grow

Liz Verna, Acting Director, Economic Development & Regional Planning Dept, Burlington County Bridge Commission

Small Business Loan Program

The Burlington County Small Business Loan Program offers low-interest loans for small businesses, including start-ups and entrepreneurs, located anywhere in Burlington County. Funds for this program were received from the United States Economic Development Agency and available in one of three forms: fixed asset loan, working capital, or direct loan. Fixed asset and working capital loans fund up to $200,000 in the form of gap financing that requires bank participation. Direct loans fund up to $50,000 and do not require bank participation.

All small business loans carry no penalty for early payoff. The term for most loans is 10 years and in some instances may be 15 years. The interest rate for all loans is 75% of the prime interest rate. The rate at the time of application is a fixed rate; the loan remains at that rate for the loan duration. The only fee charged is a non-refundable $200 to be submitted with an application.

Loans are required to promote at least one of the following economic development goals: (1) Create and retain permanent private-sector jobs within 18 months of loan funding, (2) Provide entrepreneurial opportunities for qualified individuals, (3) Stimulate private sector investments in physical plant and equipment for local small businesses, (4) Encourage the increase of available funds for local small businesses by leveraging state and private sector funds to maximum levels, (5) Stimulate balanced development.

Small Business Lenders Forum

More than 50 interested small business owners from Burlington County attended the free Small Business Lenders Forum held on Thursday, March 28 from 9-11 AM at the Burlington County Library Auditorium in Westampton.

Sponsored by the Burlington County Board of Chosen Freeholders and Burlington County Bridge Commission, the event began with welcoming remarks from Freeholder Director Tom Pullion and Freeholder Felicia Hopson. Brief presentations by 14 area lenders followed, during which they shared specifics of their commercial lending programs. Following the presentation, small business owners had the opportunity to speak with the presenters and gather important information from lenders’ stations in the lobby.

Images Courtesy of Burlington County Library System

Program For Small Business Lenders Forum

| Welcome | Freeholders Tom Pullion & Felicia Hopson |

| County Economic Development | Manager Dave Wyche |

| BB&T Bank | Anthony Fleming |

| Columbia Bank | Darrin Gould |

| Cooperative Business Assistance Corporation | Harry Stone |

| First Bank NJ | Brett Lawrence |

| First Commerce | Dan Jackson |

| Fulton Bank of NJ | Lisa Viscusi |

| Investor’s Bank | Chris Warren |

| M&T Bank | Chris Sylvia |

| Ocean First | Chris Livingston |

| Republic Bank | Pedro Figueroa and Amy Travetti |

| Santander Bank | Heather Hiltebeitel |

| Small Business Administration | Erika Pearson |

| TD Bank | Carl Willers |

SMALL BUSINESS LOAN PROGRAM

for a comparison of loans and terms

SMALL BUSINESS APPLICATION

(Direct Loan up to $50k)

OTHER LOANS AVAILABLE

Business Resource Tables

- The African American Chamber of Commerce of New Jersey

- Burlington County Bridge Commission’s Economic Development & Regional Planning

- Burlington County Clerk’s Office

- Burlington County Library System

- Burlington County Regional Chamber of Commerce

- Gruenberg Law Group

- Latin American Economic Development Association

- National Association of Women Business Owners

- New Jersey Business Action Center

- NJ Division of Taxation

- NJ Economic Development Authority

- NJ Small Business Development Center at Rutgers University-Camden

- Rowan College at Burlington County Workforce Development

- SCORE

- US Small Business Administration